Search Waypoint Resources

Adapting your Survey Approach with Adaptive Questions

By Gene Hall, CloudMR

There’s been a lot of research and articles posted over the years about how NPS-based surveys should be structured. One thing we all know is true in the limited-attention-span, on-to-the-next-society we live in: the shorter, the better.

However, three-fourths of market researchers “Agree” or “Strongly Agree” that online surveys are still too long. And naturally, about the same percentage of these professionals are concerned about the effect that has on response rates.

So how can B2B companies use the NPS mold to collect information that matters for many different parts of the business while also capturing real customer insights? Try a 2-question survey method and substitute in an Adaptive Question for the follow-up, open-ended question.

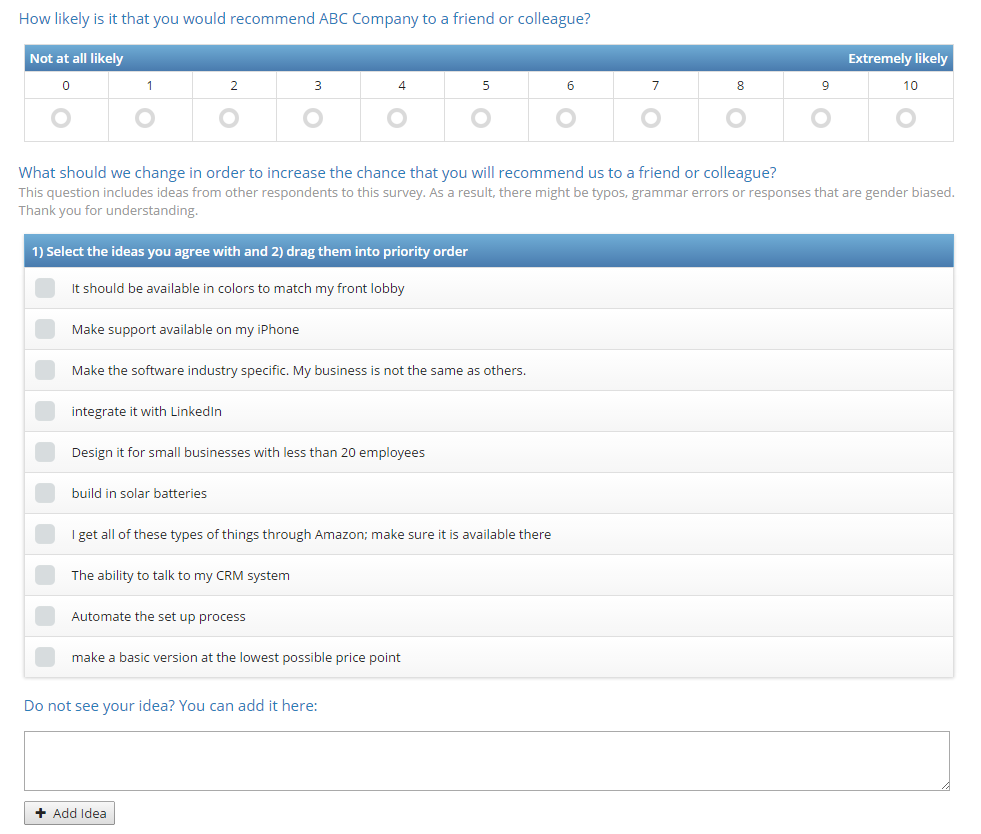

For example, check out this example below — instead of asking “Why did you respond that way?” after asking the Likelihood to Recommend, insert an adaptive question with something more action and forward-looking like, “What should we change to increase the chance that you will recommend us?”

This is where the fun begins: the answer list changes, or adapts, to the previous respondents’ answers. Each respondent sees a random set of 10 ideas from previous respondents and they select the ideas they agree with and place them into priority order. Because there is also an option to add ideas, the results accurately reflect the wisdom of customers in their own words, which may shed light on new terminology that resonates with them.

Adaptive survey design works really well for companies seeking actionable ways to improve NPS, especially with product-oriented surveys. A mutual client of Waypoint Group and CloudMR successfully used this tool to acquire suggestions and incorporate them into their product roadmap. As a result, the engineering team was able to tweak the order and timing of roadmap items based on priorities established by customers instead of internal teams. This also helped executives understand why specific product features should be moved up in importance or delayed indefinitely due to the responses from customers.

By using one adaptive question, companies can replace dozens of rating scales sometimes used to correlate different attributes to NPS in traditional surveys.

Several advantages are…

- Expect up to 40% more responses with a 2-question survey

- Eliminate time for analysis as management receives a sorted list of priorities at 95% confidence

- Confirm idea prioritization with many different customers as if conducting a focus group

- Obtain solutions not originally conceived in the questionnaire design.

- Collect ideas in “customer-speak” instead of “marketing-speak” format

- Receive two-dimensional results (1- agreement and 2- priority) for all ideas that come up during the survey

Once this kind of data is obtained, the next step of course, is to actually do something with it. And let your customers know that the time they spent (hopefully only a few minutes) giving you feedback was worth it! Otherwise, it won’t really matter how long your questionnaire is, if customers don’t believe you are actively listening, it’s all for nothing. The good thing is, this kind of approach enables action.

About the Author, Gene Hall

Gene Hall is a market researcher with over 25 years of experience designing and analyzing market research reports from high tech to ice cream and everything between. His experience includes everything from agency & client side, qualitative & quantitative, B2C & B2B, start-ups & international conglomerates. Gene’s early experience was with a P&G trained research expert who taught him the importance of appropriate design, accuracy, and actionable analysis.

Gene Hall is a market researcher with over 25 years of experience designing and analyzing market research reports from high tech to ice cream and everything between. His experience includes everything from agency & client side, qualitative & quantitative, B2C & B2B, start-ups & international conglomerates. Gene’s early experience was with a P&G trained research expert who taught him the importance of appropriate design, accuracy, and actionable analysis.

“I have always been attracted to cryptograms, Sudoku, and other types of complex puzzles. I was lucky enough to fall into a research position right out of college and realize that it was a new kind of puzzle for me.”

Gene is currently the Vice President of Market Research at CloudMR, Inc. and was previously employed at Satmetrix. His duties include research design and analysis as well as the definition of intellectual property related to market research. Gene is Net Promoter Certified and received his MBA in Marketing from the University of Oklahoma.