Search Waypoint Resources

I’m often asked questions like this one: “Can you provide a benchmark on how much a B2B company can improve NPS during the first year of the program? Our executives want to understand the ROI from the effort and this will help.”

In my experience there are 3 ways to address this question:

- Directly answer it by providing benchmarks showing other companies’ improvement.

- Find out the real question behind the question? That is, if we successfully answer the question about benchmarks, will we have addressed the need?

- Is that even the right question — is measuring and providing incentives for NPS the optimal approach?

1. As a “direct” response to the question, we’ve seen improvements in the “aggregate” by 15 percentage points or more (e.g. from a -3 to a +12) in the first year, and there are many case examples on this site and also at NetPromoter.com. The answer in this area is to look at three key ingredients: current score, key drivers, and available resources. Starting with your current score, know that, for example, it’s easier to improve a low score than a high score. From there, understanding the current drivers and their contribution to your NPS via regression will allow you to prioritize the right improvement opportunities. Implement the changes (being sure to communicate the progress) and measure the change with the same respondents over time. We’ve written more about this here: http://bit.ly/NPS-TargetSetting

That said, the more important part of the story is to describe what happened to the business when the scores genuinely improved. In the -3 to +12 example above, we also saw corresponding growth in revenue from the existing customer base and increased rates of growth overall. Of course, these improvements took years to achieve, so the necessary step is to look at leading “process metrics” that contribute the end results. If you know that in order to achieve an outcome there are certain “best practices” that need to be in place, then it would be important to measure if those best-known processes are in fact being used. More on this idea is at http://bit.ly/1BOFc4k

2. The “indirect” way to answer this question is to ask about the question behind the question. If your executives are looking for a reason to invest in an NPS program, then maybe they haven’t yet bought in. Assuming you’ve provided them with the background on the Net Promoter SYSTEM (emphasis on “system” not “score”) and how proactively caring for customers accelerates profitable growth, consider a few possibilities here (btw, there’s a whole book on this topic — http://bit.ly/CustomerSuccessBook ):

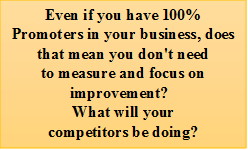

- Maybe the execs think everything is fine and there’s no reason to invest in this program… You might want to discuss the opportunities to identify and activate more promoters. Can you find an ally in the sales or marketing organization that can benefit from this aspect?

- Maybe the execs think they already know what’s going on and won’t learn anything new… Whether they “know” overall sentiment is good or bad, would anyone benefit from engaging those that love / don’t-love your firm to help validate a new solution? Can those people be advocates/proof-points once fully launched? Maybe Product Managers?

- Maybe they think customers won’t provide any new insight into helping the business grow. That is, they might believe that customers don’t drive strategy. While that might be true in some sense, the better the company can understand customer problems the better the company can develop the right solutions to those problems. The purpose of the NPS program isn’t to do everything that customers say or are unhappy about. The purpose of customer feedback is to understand the business challenges that customers face, and what your company does that is best-in-the-world at solving that problem. Who in your company cares about being able to measure the impact of customer problems, developing the strategy to address them, and measure the results (the ROI for your solution)? Maybe Product Marketing?

These are just a few ideas. The theme across these cases is to build a coalition. This is the hard work with NPS, and is needed to drive real improvements. Is there a “burning platform” that might bring attention to the effort, such as churn, missed growth targets, reducing cost of sales, improving the marketing or sales funnels, accelerating sales of a new product or service, etc.? Unless people (departments) are bought-in and part of the process in advance it will be extremely difficult to action the feedback results down the road. The easiest way to do that is to avoid creating something new. Instead, link VoC/NPS to a key initiative or process already underway that will benefit from feedback. There must be a business reason for the effort – what problem are you really trying to solve? Who in the company cares about that problem?

Building the coalition is the tough work and cross-functional improvements (product, service, support, distribution, and more) generally can’t be done without it. It’s sort of a “slow down to speed up” approach. We frequently want to jump in with the survey process because we already know the insights and benefits that customer feedback can provide. We live and breathe this stuff and intuitively understand the benefits. Most people aren’t as experienced in this area so you’ll need to take them along on your journey. While we want to go for the “home run” and get funding for a full program, sustainable programs come from genuine “change” and start at the beginning with individuals, one at a time. Think about going for a series of “base hits” that ultimately win the game (small scale “pilot” projects can be an easy way to partner with key stakeholders).

A final comment for this approach comes from the recent HBR article, You Don’t Have to Be the Boss to Change How Your Company Works. Using an “…incremental approach can help you avoid some of the major pitfalls that threaten efforts to drive change…. Messages are more persuasive when they seem to arise from many people, and they’re less easily dismissed as one person’s “pet project.””

3. The last point is regarding the measurement itself. Is Net Promoter Score really the thing you want to measure when starting out? While focusing on other metrics may seem counter-intuitive, we’ve all had experiences with companies that focus on scores and we’ve been less than happy with the result. If you’ve ever had your car serviced at a dealer then you know what I’m talking about (“The only thing that matters is a 10. If you can’t give me a 10 please tell me now”). Every metric will have a numerator and a denominator, and there are many ways to “game” NPS to reach the desired targets.

So be sure to discover what it is that you really what to measure. Especially when starting out, NPS on its own is a severely lagging metric. (Longitudinal trending, where you assess responses from the same people over time, is the ideal way to measure change, and you’ll need about a year to get there). So I don’t think what you are after is a “score.” What you are probably after is an improvement in the business. Consider this: Which headline would you rather have on LinkedIn?

- I am a VoC/NPS Program Manager, with results that include improving NPS from +35 to +47 in 2 years; OR

- I directly drove the firm’s profitable growth rate from 7% to 9% year-over-year, adding over $52MM to the bottom-line by driving organizational alignment around the voice-of-the-customer.

So assuming your objective is the second item, you probably know there are many “moving parts” to consider in running a B2B Net Promoter program:

- How will you know if you are getting feedback from the people that really matter (i.e. influence purchase decisions) in your customer accounts?

- What will you do if the survey achieves a 25% response rate? Is this good enough to present a Net promoter Score? Does it truly represent the business?

- What if 80% of the responses to your survey come from only 20% of company revenue?

- If scores in a second wave are 10% higher than scores in the first wave, but the sample is totally different, how will you know if there was genuine improvement versus just a change in sampling?

In other words, the company can hit the Net Promoter Score target yet still not have any business improvement to show for it. How would that impact the program?

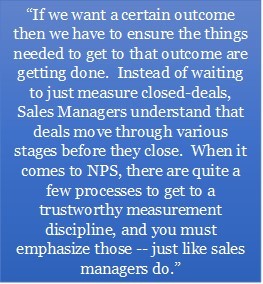

Here’s another example. We know that companies generally desire year-over-year growth in profits. So they measure revenue and profit margin, and it takes over a year to know if they hit the targets. Profit is a lagging indicator, so smart companies also know what it takes to drive increases in profits and they establish measurements of those key processes as leading indicators. “Sales Process” metrics are great examples. Instead of waiting to just measure closed-deals, Sales Managers understand that deals move through various stages (qualification, value/pain quantification, solution development, proposal, etc.) before they close, and therefore can better forecast and course-correct by examining those sales-stage metrics.

If we want a certain outcome then we have to ensure the things needed to get to that outcome are getting done. When it comes to NPS, there are quite a few processes to get to a trustworthy measurement discipline, and you must emphasize those — just like sales managers do. For example, if you know it takes acting on feedback from the right people at the right time in order to improve your NPS and associated profits, then why not measure and establish incentives around those processes*? You’ll end up with an easier time getting the organization to do the things that drive a trustworthy score, and you’ll know sooner rather than later if you’re on the right path.

Net Promoter takes a whole company. You can’t have one part of the company setting and managing customer expectations (Sales and Marketing) while another is completely separate from delivering on those expectations (Product and Service). As you form your coalition, what questions and objections do you hear from people that need to get in the boat and rowing in the same direction?

* A more detailed whitepaper on important KPIs can be found by following this link under the heading, “What’s on Your Dashboard”