Search Waypoint Resources

Benchmarks for Customer Success

Benchmarking for Customer Success:

Keep Your Eyes on Your Own Customers

Every company wants to be one step ahead of the competition. And increasingly, customer experience and customer success have become distinguishing differentiators for beating them. So, once you collect customer feedback and calculate an NPS, it’s very tempting to be lured by the question, “How does that compare to our competitors?” While this may be an interesting fun fact, this isn’t a question you should focus on — because unless you have competition within your accounts (more on this later), the answer is of no real use.

We’ve questioned the use using external benchmarks in previous posts, but we should highlight why looking internally for more context and clues for improvement from your own customers is the solution.

Why internal benchmarks for customer success make more sense:

1. Only your own data will point you to where your company is missing the mark.

A competitor’s NPS has nothing to do with the way your business performs. Looking elsewhere is a distraction from the specific items you need to change to impact customer success. Sure, seeing a competitor with a high score may propel your company to want to improve, but shouldn’t you strive to do that anyway? Creating internal benchmarks for success will actually help accomplish the goal.

2. Internal benchmarks for different parts of the business tell a more complete story that help prioritize action.

Your questionnaire should ask about specific parts of your company that give better insight into where customers think you fall short and what you do well. For example, you could ask them to rate the Account Manager, Ease of Getting Support, the Technology you provide, and/or Quality of Training.

Unless you’re really great at closing the loop with every. single. respondent. (and let’s be honest, this is really hard) to find out more about why they would or wouldn’t recommend you to friends/family, you need to ask more than 2 questions.

With richer data, your team can look deeper into various segments of your business and understand where a breakdown in CX or CS is happening.

You can slice the data by Industry, Region, Product or by Strategic Accounts — whichever are very important parts of the revenue stream.

How does one Strategic Account feel compared to other similar accounts in their view of different attributes you might ask about in the questionnaire?

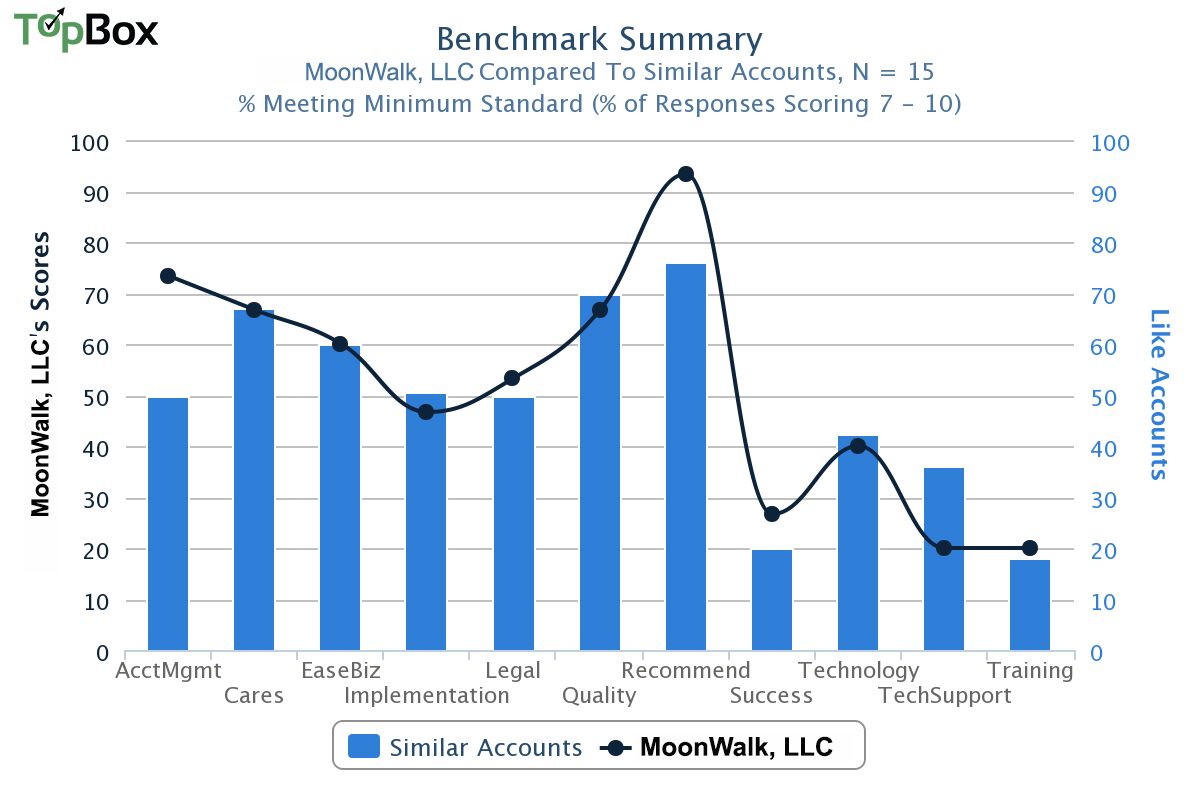

This chart below shows that your customer, Moonwalk LLC, is happier than other Strategic Accounts with Account Management. Why is this? They may not even have a different person managing the account — were their expectations somehow different? How were those set and maintained?

Having an internal benchmark to understand the gaps with a segment can help your team prioritize what would make the biggest difference in customer success. While Tech Support doesn’t have the lowest score, the gap is wide enough that there are some misaligned expectations with the delivery of Support. Drilling into the specific account responses will help pinpoint who to speak with to discuss where the disconnect is happening.

This graph also shows that Training is a low point across the board. While the gap between accounts is slim, the score is low enough that perhaps this is a good place to start in increasing customer success overall with this segment?

3. Internal benchmarks by segment bring a true apples-to-apples comparison of your CX.

The accounts in this group have had similar interactions with your company and can truly be contrasted. Depending on what product your customers by, they likely receive different treatment. So lumping all customer feedback in one big group to improve customer success doesn’t really make sense.

One instance where looking at external benchmarks would give an equal comparison, would be if your customers also use competing vendors and you ask them to rate you against their performance. This would qualify as competition within the account, so you’d want to know how your CX compares directly.

So there you have it. Internal benchmarking is just one aspect of feedback analysis that can help customer success teams to take action and get more insights from the data. Account based reporting can help uncover other leading indicators of relationship health like which customers have had more engagement, if Decision Makers feel differently than End Users, and which groups of customer have had superior service.

And don’t forget to spread this information across the company! Product, Sales and Marketing can all benefit from this information to realign expectations from the onset. If you’re asking customers to take the time to submit feedback, don’t let it go to waste. Put it to good use by sharing the insights to find customers that fit your sweet spot and fuel future success.

Hear how the team at ShiftPlanning has been able to take advantage of account-based reports like this one and share the insights across the company in our latest case study.